There is certainly a lot of ‘noise’ floating around at the moment about what is going to happen next with the UK property market.

So here is our take on it…

(We’ll give you a hint – it’s not as negative as you think)

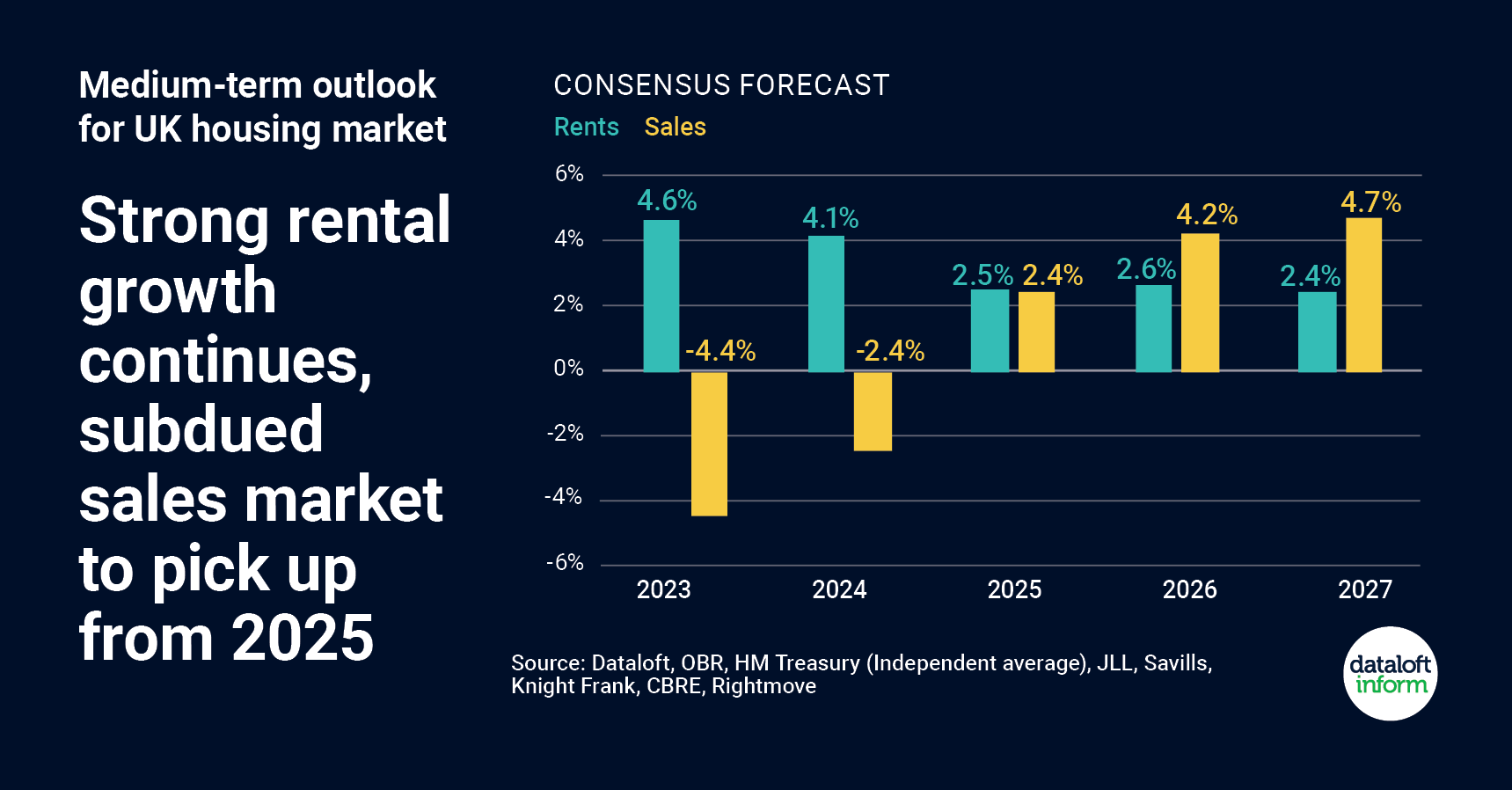

Rental price growth is set to outpace sales price growth over the next two years. Driven by a shortage of stock and increased demand, rental growth averaging 3% per year is anticipated for the next 5 years.

The average of the forecasts we have collated suggest UK house prices will fall by a total of -7% over the course of 2023 and 2024. At worst a fall of 10%, which is being forecast by some, will only take prices back to the summer of 2021.

A decline in the number of homes sold in 2023 is likely, taking the annual total closer to 1 million, from 1.3 million expected this year.

On a positive note, there is already evidence of improving affordability and choice in the mortgage markets and if this continues it should help to boost levels of buyer demand.

Source: Dataloft, OBR, HM Treasury (Independent average), JLL, Savills, Knight Frank, CBRE, Rightmove, Zoopla, UK Finance

So, what’s the good news?

- The rental market will be extremely positive for Landlords over the next five years (maybe a positive sign to look at investing)

- With the market settling down now buyers will have better opportunities when trying to secure their next home.

- House prices still remain over 10% higher than pre-covid which is positive for current homeowners

- Mortgages are showing signs of decreasing as of Christmas 2022