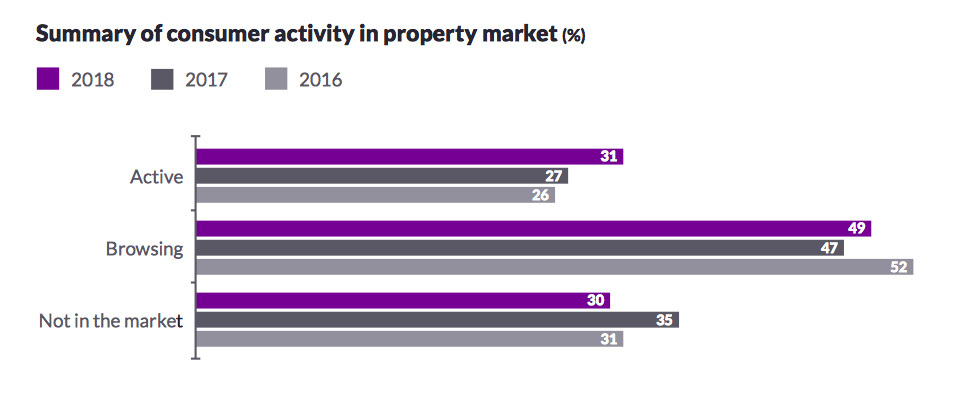

Over 6,000 consumers across the country were surveyed on their views of the property market and one of the biggest findings was the increase in activity from potential buyers.

A recent Zoopla report has revealed that 33% more consumers are looking to buy their own property, since 2016.

- 16% are actively looking to buy their own home (up from 12% in 2016) and 10% are looking for Investments (Up from 7% in 2016).

“Since the down-turn in 2009, I have seen a nice steady rise in active buyers, home-movers and investors”…..said Paul Campbell.

The cost of buying is still cheaper than renting however the mortgage affordability ‘stress-test’ still remains a barrier for first time buyers.

“I have helped many first time buyers raise sensible deposits using family money but, I agree sometimes it can be difficult. However it is always worth popping in for a chat just in case we have a method you haven’t yet considered”… said Paul.

It has also been revealed that first time buyers are set to become the largest buyer group as regional markets see further growth.

29% of young families that own a property are also actively looking to move, making them the second most active group.

31% of everyone surveyed said they were looking to move in the next year and have made a decision on exactly where they want to be, with 48% of young families knowing which specific street or even house they wanted, making availability challenging for young families looking to up-size.

55% of consumers also expect house prices to rise by 12% over the next year which Zoopla have suggested “could potentially cause a significant issue in the market, whereby sellers expect much higher valuations on their homes than Agents are likely to give”.

“I’m not so sure about that myself’ commented Paul. “Neither of us really know, but with my knowledge and experience I expect prices to remain steady over the next 18 months. I think it’s a good opportunity for first time buyers while the market is steady”.

House price inflation is expected to be between 2–3% in 2019 according to the latest Zoopla report.

You can read the rest of the report here: https://advantage.zpg.co.uk/wp-content/uploads/2018/11/State-of-the-property-nation-2018-report-v2.pdf